Following the tighter measures in France and Switzerland, Prêt Immo Conseils maintain its sustainable and specific support including the study of your future property project, assessment of your loan application, consolidation of your home loans or search for borrower insurance.

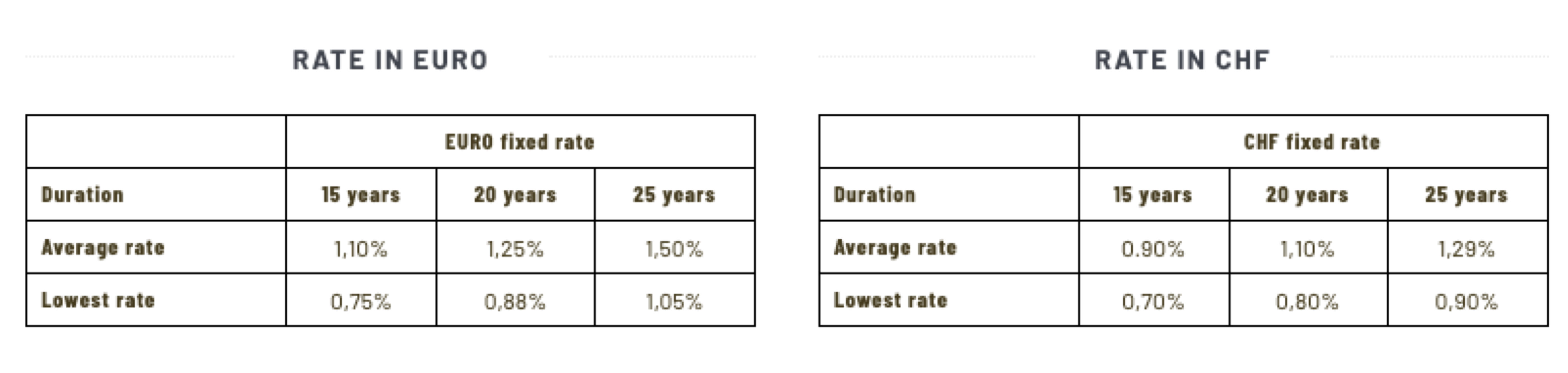

There is every reason to believe that the current situation will drag on in terms of health and economics changing your priorities and daily routines. However, customer quality records remain attractive for the banks even if the conditions of granting have tightened, in particular for non-resident people, whose profile is usually reassuring in terms of risks. With regard to interest rates, as shown in the table above, they are on the decline again to attract new prospects and increase the sluggish production of some banks.

Financial modeling of your future residence or investment, repayment capacity, contribution required according to your status (non-resident, cross-border workers, first-time buyers), various costs (real estate, notary fees, loan insurance), impact of the changing situations (personal, professional, cross-border status) are questions that our firm can answer with providing you solutions thanks to its expertise in property financing for 25 years on the Swiss-French border area.

For more information, please call us using our contact form